How did the lamb market get here?

Article written by Rob Herrmann, Mecardo

It all starts with drought

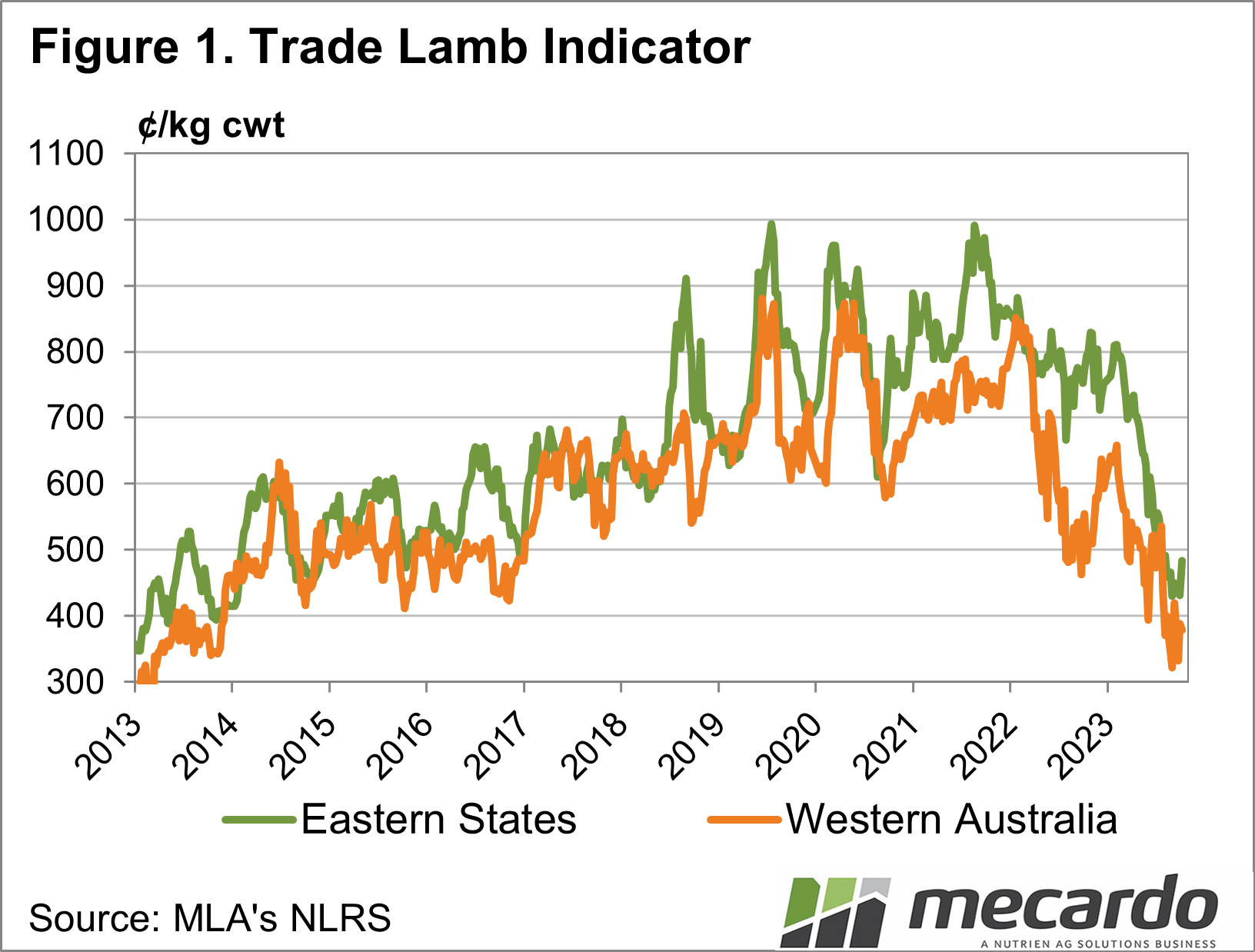

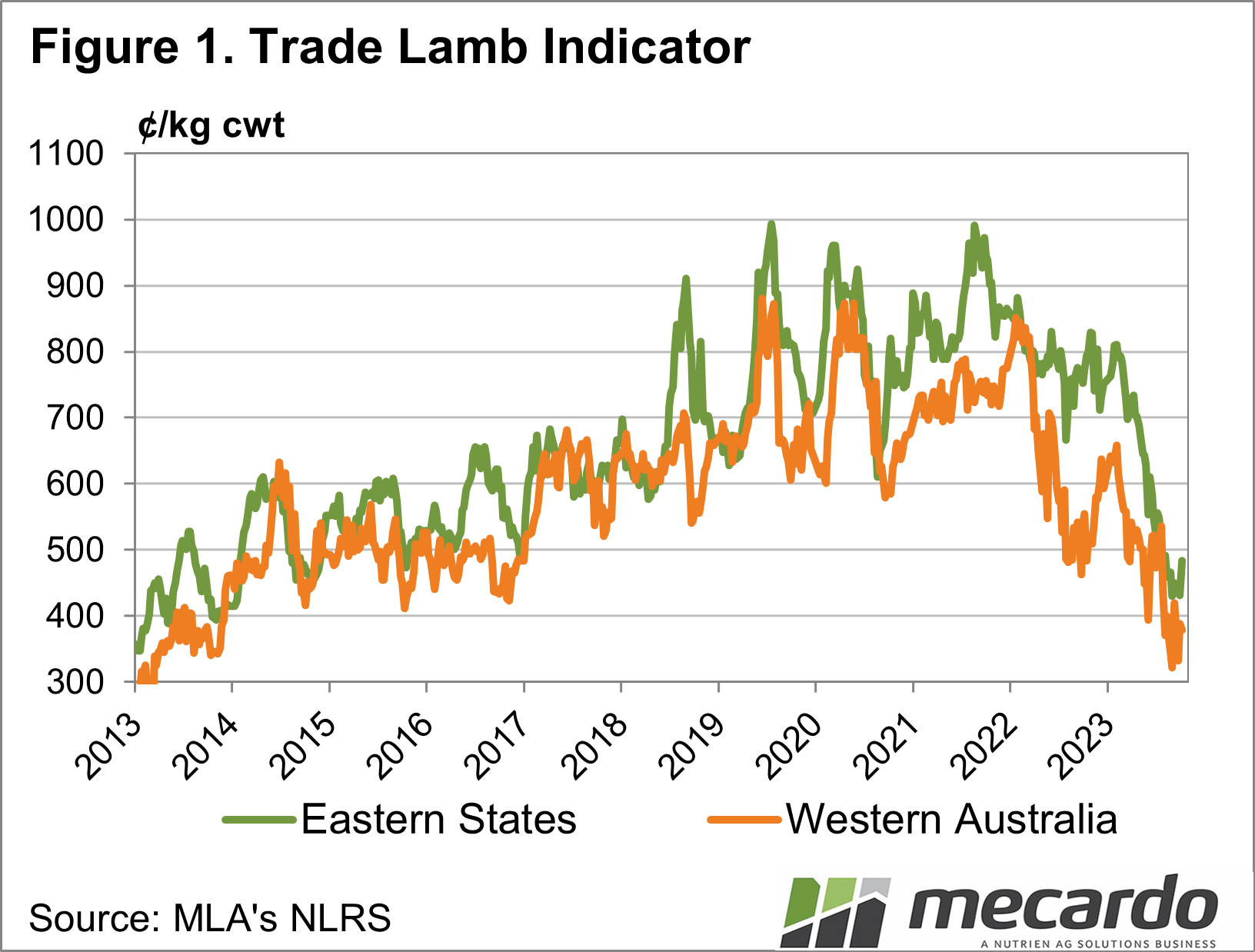

To understand the fall, we need to first look at the drivers of the extreme prices we saw in the 2019 to 2022 period. The drought, or the breaking of the drought was the significant factor in the early part of 2020. The break in the season, combined with rising market prices encouraged producers to rebuild the flock. Transporting circa 2.0 million sheep from WA was also a factor, but it was the excellent pasture growth on paddocks that were understocked because of the drought that gave producers the incentive to retain breeding sheep to bolster their flocks. This enhanced breeding flock went on to produce the large “crop” of lambs now coming through the system.

The retaining of sheep to build flocks came at a time when the world’s consumers were looking to build buffer stocks, there were real concerns that the “just-in-time” supply systems they had built were vulnerable in the Covid pandemic. So tight supply and strong demand were in play, the “perfect storm” for a market boom.

The cure for high prices

The downturn in the market was in the first instance, a response to the extreme prices. There is nothing like high prices to fix high prices! We also know that we lost existing markets as sheepmeat prices reached unaffordable levels for some key customers, further compounding the retracement when it came and reducing demand.

However, there were two game-changers that were of most significance. Close to home was the increased supply offered to processors as a result of the flock rebuild. This was the major factor in the increased supply situation.

Flood of supply meets supply chain challenges

Running alongside this was processing capacity limitations. Meat processors were still recovering their staff levels post Covid-19, and while they have remarkably been able to process record numbers in recent times, the “catch-up” phase was a drag on their demand when supply increased. This is particularly an ongoing problem in WA, where labour availability is scarce, and the live export debate has contributed to increased sheep turnoff.

The elevated overseas meat stocks issue has also contributed. As the risk of Covid-19 induced supply interruptions reduced, overseas customers began changing their view on the risk to their reliable supply. Customers who were building meat inventories to mitigate supply risk have this year decided to reduce back to more normal levels and not to continue holding excess stocks.

Markets adjusting to the new level

But we are seeing positive signs for the longer term. There are already examples of new or returning markets to Australian lamb & sheep meat because of the cheaper saleyard prices. As an example, the light lamb that in the past two years that was purchased by restockers, is now finding its way to the Middle East on planes as “lightweight bag lambs”. This will have an impact in the back half of this selling season. Over the past two years these lambs haven’t arrived at the processor until the Feb – April period, and then as heavy lambs. It is also of note that contrary to previous seasons, the lamb market in the Autumn & Winter period has failed to rally mostly due to more than adequate supply because of restocker activity. There will be less lambs available in the March to July period this season so perhaps the market returns to more normal patterns?

These factors will be at in the minds of those producers who have the capacity to background lambs. It has been years since the buy-in price of a 36 Kg LWT lamb has been at these levels. With the three components of the trading equation consisting of buy price, weight gain (as well as cost of gain), and sell price, the first part of the equation looks attractive.

As with high markets, low prices are a cure for low prices. Demand for lamb at the new price point is on the up, with retailers now able to offer specials to attract the consumer. Spreading this demand across more diverse markets will open demand and competition, as well as diversifying further market risk.

When will it improve?

It is not possible to say that we will see a quick fix; there is not just one issue impacting the market. With supply more than meeting demand and processing capacity, and with the current large numbers still to come this season, the current price level might be where we sit for some months. The global economy also poses concerns for demand, and while it is not clear as to its future direction, we know uncertainty in the world conspires against commodities.

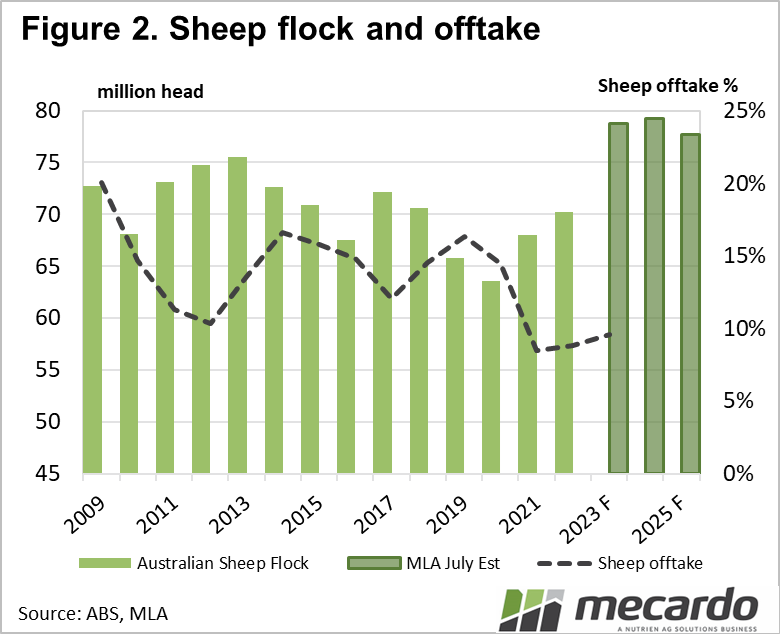

On the export front, our biggest lamb customer last year, the US, is currently relegated to number 2 spot, with volumes down 16% year on year, however the new number one customer China is up a massive 37%. China is now the biggest customer of Australia’s total lamb exports YTD, up 12% higher than in 2022.